The impact of Ferronickel on Exports

30/03/2016

The metal extraction and processing sector, including nickel, is one of the key sectors of employment and exports. This sector employes approximately 1.5% of all employees in Kosovo. In the period 2012-2015 the export of ferronickel accounted for about 30% of Kosovo exports. The main export markets for ferronickel are Italy, India, and Germany. Ferronickel is mainly exported in the processed form and is used as a raw material to manufacture other materials. For example 2/3 of the global supply of nickel is used to manufacture steel.

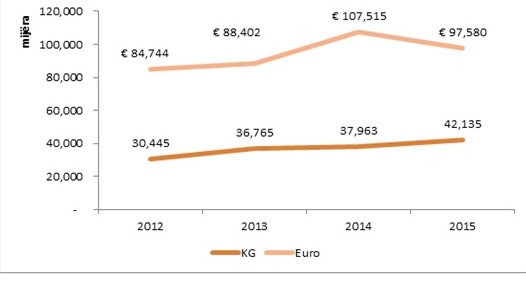

Figure 1 Ferronickel exports

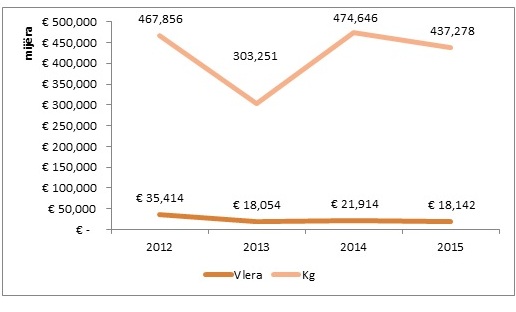

In the past four years, Kosovo has exported about 378 million euros or 147 thousand ton of ferronickel. About 45% of the exports are regular, whereas the rest are re-exports. A part of the exports takes place after importing ferronickel ore. In the period 2012-2015, Kosovo has imported around 93 million euros or 1.7 million ton of ore. 99.7% of them are temporary imports which are exported after processing, while only 0.03% is for domestic use. In the period 2010-2014, Kosovo used about 562 thousand ton of ore per year.

Figure 2 Regular and temporary imports

Price Crisis

On April 1, 2016, New Co Ferronickel Complex, a privatized company in 2006 in Kosovo, decided to temporarily stop ferronickel production and consequently its exports. According to the company’s management, the exports will be ceased for three months and the employees will be paid 50% of their salaries. The reasons behind the temporary plant shutdowns are the dropped nickel prices in the stock market and the need for technological repairs.

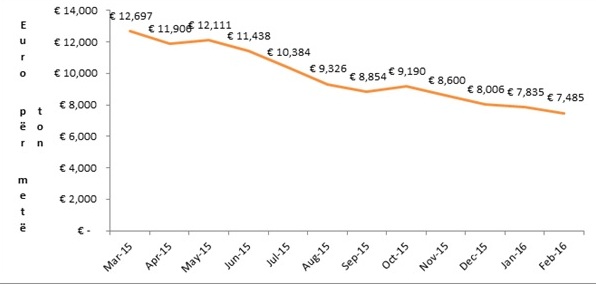

As shown in the graph below ferronickel prices have progressively dropped. According to Credit Suisse, in November last year, half of the production of nickel in the world was operating at a loss. [4] The causes behind the price declines are: fluctuations in the Chinese economy as one of the major steel producers (ferronickel is used in the production of steel), a fall in construction investments in China, slowdown of the growth of emerging markets.

Figure 3 Ferronickel Prices in the Stock Market

Source:http://www.indexmundi.com/commodities/?commodity=nickel&months=12¤cy=eur

According to financial analysts, nickel is one of those metals whose price can rise very quickly. During this year its price could go up 20%, whereas next year it could go up about 40%.

In some countries like the UK a discussion on lowering tariffs to help the industry is being held, but this risks breaking EU regulations on state aid. Until 2011, New Co Ferronkeli Company, held the status of a privileged energy consumer. With this status, the company had the right to choose an electricity supplier from other countries.

In 2014, Indonesia blocked nickel exports in order to encourage manufacturers to produce solvents which provide additional value to the resources and create new jobs.

Sources:

[1] Independent Commission for Mines and Minerals, Annaul Report 2014

[2] http://top-channel.tv/lajme/artikull.php?id=323369

[3] https://www.youtube.com/watch?v=AAzut_DAnBM

[4] http://www.forbes.com/sites/timtreadgold/2015/11/13/iron-ore-crisis-could-be-followed-by-a-nickel-crisis-for-bhp-billiton-and-vale/#50b2454c1c10

[5] http://www.reuters.com/article/us-metals-poll-ahome-idUSKCN0V724F