Stimulating the economy through Fiscal Package 2.0

23/10/2017

At the 149th meeting, the Government of Kosovo, based on decision no. 08/149 has approved the list of measures of fiscal package 2.0 and has obliged the Ministry of Finance and other responsible institutions to take the necessary actions to prepare the relevant documents under their authority.

The taxation system is a powerful instrument of public institutions which aims to influence income, consumption or investment that would, in principle, lead to economic growth and increased employment.

Fiscal Package 2.0 contains 22 measures aimed at promoting investment in Kosovo by providing incentives for producers and sectors that have greater potential for growth. The issuance of sub-legal acts for each measure is meant to concretize the incentives and also to enable businesses to use them. Four of these measures were to be prepared in July and eight of them in September, but the political blockade even after two months since parliamentary elections has hindered the process and it does not seem that the situation will be any different in the coming month.

Given that fiscal policies can have positive effects, for example, increased investment in the agricultural sector, but at the same time negative effects, such as reduced state revenues due to tax breaks, tax cuts, or exemptions from income tax of said sector, the drafting of a sound tax policy is essential.

According to an International Monetary Fund (IMF) analysis, many low-income countries use tax breaks and income tax exemptions to attract investment. But, these incentives targeted to the internal manufacturing sector or extractive industries have little impact compared to export-oriented industries. Moreover, there is always a risk of damaging tax competition between industries. However, good infrastructure, macroeconomic stability, and rule of law are key to the effectiveness of such policies.

In the statement of the Ministry of Finance, Minister Hoti said that the measures within this package originated from the identification of business needs either through meetings, roundtables or on-site visits as well as from the success of the previous fiscal package which entered into force in 2015. But what exactly is included in the measures of the fiscal package 2.0 and what is their purpose?

The measures of the fiscal package 2.0 prescribe amending and supplementing three laws, issuing five administrative instructions (AIs), two legislative acts (administrative instructions or regulations) and amending an existing administrative instruction alongside some administrative procedures and government decisions.

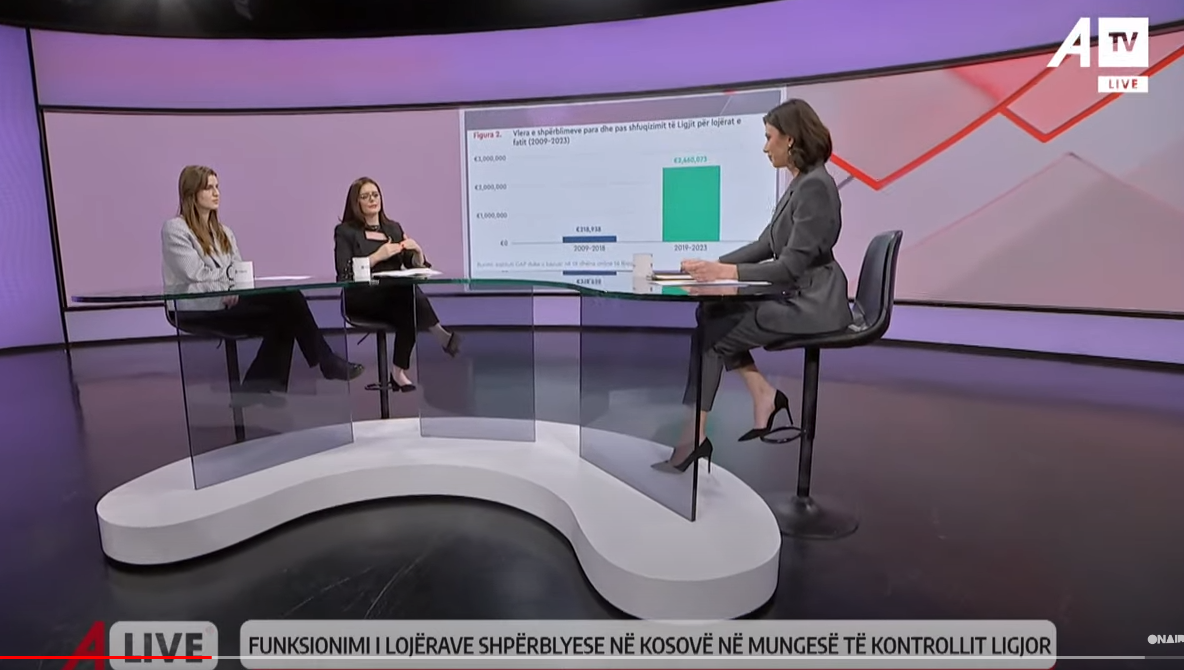

Among law revisions is that of the law on gambling in order to harmonize legal requirements with best international practices to create the necessary conditions for the full control and formalization of this sector. The law will oblige such businesses to withhold tax at source by gamblers. The amendment is to be completed in September 2017.

Likewise, the law on Corporate Income Tax (CIT) and Personal Income Tax (PIT) will be supplemented to address taxation of insurance companies and the reduction of withheld tax on agricultural product collectors. The law on VAT is also expected to be amended to address issues such as the taxation of international road transport of passengers under EU directives and the treatment of investment gold. The latter will be followed by an administrative instruction which is another measure within the package. Investment gold will only be taxed for the work spent on decoration, pure gold will not be taxed at all, and the law shall also treat the second-hand trading of gold, i.e. it being bought by citizens. Both of these laws are expected to be amended/supplemented in January 2018.

Another main measure is the administrative instruction on establishing the criteria for manufacturing companies’ status approval which would be exempt from customs duty on raw materials. The AI is to be issued in October 2017. Establishing and implementing proper criteria in the process of approving the status of manufacturing companies so that there is no misuse by non-manufacturing companies is indispensable. But most importantly, manufacturing companies will be stimulated to increase investments when their costs are reduced.

Additionally, the measures foresee the issuance of an administrative instruction for amending the list of articles that may be subject to a reduced rate of 8 percent of VAT. The list shall include cultural, artistic, sports, tourist, accommodation and recreational activities as well as fish processing to provide incentives for such categories. There will be issued another administrative instruction on tax breaks for specific periods to promote investment in particular sectors with potential for economic growth and employment in Kosovo, including agriculture/agro-processing, tourism and IT. Both of these AIs are to be issued in September 2017.

Other administrative instructions to be prepared are those for losses from the breakdown, evaporation or weight loss of oil and its products (July 2017) for the specific conditions of flour identification, control and marking (July 2017) as well as advancement of the fiscal system through an IT platform (January 2018).

Other measures of fiscal package 2.0 are:

- Amendment/Supplement of the March 2015 government decision to enable exemption from excise tax on mazut (fuel oils) used for manufacturing

- Approving a government decision to reduce excise duty on carbonated and non-carbonated drinks as well as for ethyl alcohol for use in medicine

- Creating a list of local manufacturers that will be reviewed annually according to administrative procedures prepared by TAK, Customs, MTI and MAFRD

- Creating new tariff codes for some products based on European Union practices

- Creating administrative procedures for drafting vetting criteria for companies

- Creating a transparency portal for handling business license requirements

- Regulating the online sales market through a new controlling digital platform

- Regulating the trading market of mobile phones through a regulation that will clarify clearance procedures

- Issuing procedures to regulate the import of partial-form manufacturing equipment and the import samples that are only for advertising purposes

- Establishing an inter-ministerial commission for reviewing business complaints for potential market monopolies

Fiscal Package 2.0 would help a range of businesses, whether through tax exemptions, tax cuts, criteria to qualify as a manufacturing company, rating, and at the same time the state would benefit from better control of tax revenues leaving no room for fiscal evasion in the absence of clear policies. Yes it has already stagnated. The political blockade in the country and the freezing of the constitution of the assembly is leading the country to losses on all sides. Not only are they leaving the citizens waiting, but businesses are also losing opportunities to increase their investments by reducing tax costs from these incentives, and at the same time hindering the creation of potential new jobs.